Just a little note before you read on, this is SUPER LONG with only the header picture and one other picture!

A lot of you already know that groceries are a

HUGE area of the budget, but also an area that is often flexible. I read time and time again that cutting the grocery bill is one of the most important steps in taking control of your finances, and having done it in the past myself, I know this to be true.

And, I'm not talking about eating ramen noodles or other super cheap, not very good for you food, either.

As many, many blogs, financial experts, and nutrition experts will tell you, you

CAN eat incredibly well (of course, "incredibly well" is subjective) on a tight budget. I wouldn't say my son and I eat "incredibly well" but we do eat adequately well--we eat a healthier diet than most of my coworkers, most of my extended family, and many people I know generally. We don't eat as well as we could, but we eat well enough.

So, how do I save money on groceries, still eat well enough, and not go crazy with extreme couponing (another subjective term--"extreme")?

I combine grocery weekly store ads +

an inventory of my fridge, freezer, and pantry +

SavingStar rebate offers + printable coupons from Coupons.com

BUT printed via

Swagbucks. When I started this process, it used to take me a few hours once every week. Now I have it down to about a single 30 minute session every Tuesday or Wednesday night (sometimes Sunday, depending on my work schedule).

Today, I'm going to walk you through my process. Incidentally, while preparing to write this, I realized that I neglected one step

last week and ended up spending several dollars more than I would have if I'd stuck to my usual steps.

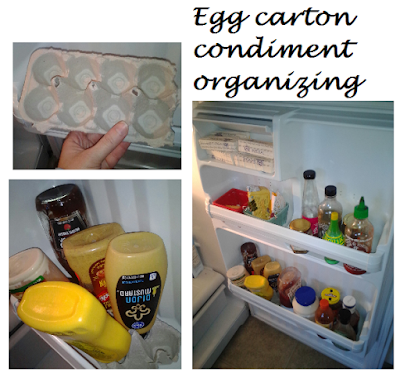

STEP ONE: I organize and mentally inventory

my fridge, freezer, and pantry to make a list of things we

NEED and things that we don't need now, but will need soon. I also include things I would

LIKE, but could do without if I can't find a good price. I usually write it all down by hand, then go to my computer for step two.

STEP TWO: I compare my written list of needs and wants against the grocery store weekly ads for the three shops I visit regularly that have weekly ads, in addition to keeping in mind items that I buy at Trader Joe's, WinCo, and Costco.

I list each store and the sale items and details on a spreadsheet, following these rules:

- Is the item something we need (as in, we are out or almost out of an item we already use)?

- Is the item something we will use up entirely before it will go bad?

- Is the item something we LIKE? (If you don't like something on your list, don't buy it! You aren't likely to use it or get it's full value.)

- Is the item actually a good price (the longer you follow this process, the easier it will be to tell a good price from an ok or a bad price)?

If I can answer

YES to each of these questions, the item and details go on my spreadsheet. As I add items for each store, I also am comparing prices if multiple stores have similar or the same items on sale. If three stores have cucumbers on sale, but only one has the lowest price, I will then decide if that store has enough items on sale to make it worth going. If it does, I keep cucumbers listed under that store's list. If that store isn't worth going to because of how few items are on sale there on my list, I will go to the next cheapest source. It's not worth driving 20 minutes away

JUST for cucumbers to save 9-cents. If the store 20 minutes away, however, has ten things on sale and I could save three or four dollars total, I might make that drive in conjunction with other errands that take me that direction anyhow.

STEP THREE: I visit

SavingStar to see what rebates they are offering that week or month and activate the offers that interest me. SavingStar works by offering you rebates for certain purchases. They also have a healthy offer of the week (a particular produce item) and occasionally have a freebie offer. You buy the specified amounts, submit a picture of your receipt and type in the bar codes or produce codes on the items you purchased. Then, SavingStar employees review your entries and approve or don't approve them. As your entries are approved, you start to accrue rebates. Once you hit $5 minimum, you have the option to cash out. I believe there are a few methods available for receiving your rebate, but I always take mine via PayPal.

I activate offers

BOTH for items on my grocery list

AND for items I think I

MIGHT want in the future if they aren't on my list for the current week. I then enter the details into my grocery list spreadsheet. Ideally, I'm looking for items that are on sale at my local stores

AND have associated SavingStar offers.

STEP FOUR: Next, I visit the coupon section of

Swagbucks (it's under the "shop" link and then you click "coupons" and then click "printable"). I

ONLY clip and print coupons for items I

KNOW I will buy since I don't want to waste printer ink or paper (aka--money!). Again, I am ideally looking for sales prices on my grocery list items+SavingStar rebate offers+coupons.

I feel like I've hit the jackpot when I can match up sale prices

PLUS SavingStar rebates

PLUS STORE coupons

PLUS MANUFACTURER coupons. I have ONE such item on this week's list: Angel Soft toilet paper. I scored a great deal last grocery trip on some Angel Soft, but still have $7.50 worth that I would need to purchase in order to qualify for a SavingStar rebate ($5 rebate on $15 combined Angel Soft purchases).

Using these steps, I routinely save anywhere from 30 to 80% on every grocery trip, so long as I don't give in to impulse purchases.

So, now that I've explained my process, here is my grocery list for this week with some LOW PRIORITY items that can wait until the next two weeks, or even next month--HIGH PRIORITY items are boxed in green, LOW PRIORITY in red, and items that would be helpful but aren't essential are unboxed.

Not including Costco, my total grocery budget for this trip will be $65

AFTER coupons but

BEFORE SavingStar rebates. Then, for the remainder of the month, I will budget $20 for produce as well as rice milk from Trader Joe's if I don't make it to Costco. Although I want to go to Costco, it is quite far from our house and I could just pick up single cans or cartons of most items on my Costco list at fairly good prices. Costco will only happen if I earn an extra $75 between now and the end of the month. The crockpot listed under Fry's will also only happen if I earn an extra $20 before they go off sale.

I buy olive oil, frozen chicken, and frozen fruit almost exclusively at Trader Joe's because after three years of living in this area, I've found Trader Joe's to have the lowest prices on these items without sacrificing quality.

You'll also notice that I have a crockpot listed. If I don't buy the crockpot during the current sale period, I will set aside $1 per pay period until I have $20 and then will just buy one when they are next on sale.

Now, why am I even considering BUYING a crockpot when I'm supposed to be doing a spending freeze (have I even written about my spending freeze yet?)??? Quite simply because it will

HELP my spending freeze in the long run. The spending freeze is about NOT buying NON-essential items, and I believe I can make a good case for making the crockpot exception.

On days that I work 10 hour shifts or have a quick turn around between shifts, it is incredibly tempting to stop at the store for a freezer meal or to hit up fast food on the way home. The simple convenience of throw ingredients in, turn it on, and forget about it for hours is so easy! I can even put all the ingredients in a big bowl in the fridge and leave my son instructions to dump it in the crock pot and turn it on at a certain time. That kind of convenience could save me a lot of money in the long run.

When we lived in another city and I was working 60 hours per week with an additional 20 hours of commute time, the crock pot not only saved me a ton of energy, but it saved me a ton of money, AND it gave me peace of mind that my son could just dump everything in and turn it on at an appointed hour if I couldn't do it before I left for work. It also allowed me to make large portions of many meals and freeze half or two thirds for future easy thaw-and-heat meals. It also was easy to make up many recipes and freeze them UNcooked and then just dump them into the crockpot in the morning. I swear the crockpot saved us many times during that period in our lives! Unfortunately, I dropped the insert and it became unusable. I didn't replace it and slowly found myself spending way too much on reheatable processed foods and fast food on days that were draining mentally and physically.

What is your grocery strategy?

~*~*~*~*~

You can read all of my grocery related posts

HERE.

~*~*~*~*~

Posts on this blog may include affiliate links.